Business Advice Blog

Why SMEs Should Prioritise Professional Bookkeeping Services

Running a small or medium-sized enterprise (SME) is no easy task. You’re constantly managing numerous responsibilities—from handling operations to leading your team and driving sales. Amid this whirlwind, staying on top of your finances can feel overwhelming.

Business Finance 101: 2024/25 Tax Year Key Dates

It pays to be well organised when it comes to tax. There are key dates throughout the financial year which you don’t want to miss.

Autumn Statement 2023: Understanding the Implications for Your Business

Today, we turn our attention to the Autumn Statement delivered by the Chancellor of the Exchequer, Jeremy Hunt. But what does this mean for businesses? Let's take a closer look.

Why Your Small Business Should Use an AAT Licensed Bookkeeper

As a small business owner, you understand the importance of keeping your books up-to-date and accurate. However, bookkeeping can be time-consuming and challenging, especially if you're handling it alone. That's where professional bookkeepers come in - they can help you stay on top of your finances, meet important deadlines, and make informed decisions about your business.

Announcing Our New Partnership with Crezco - Simplifying Payments for Small Business Owners

As a small business owner, managing finances can be a relentless task, especially when making and receiving payments. This is where HiThrive comes in, striving to make payment processes smoother and more efficient.

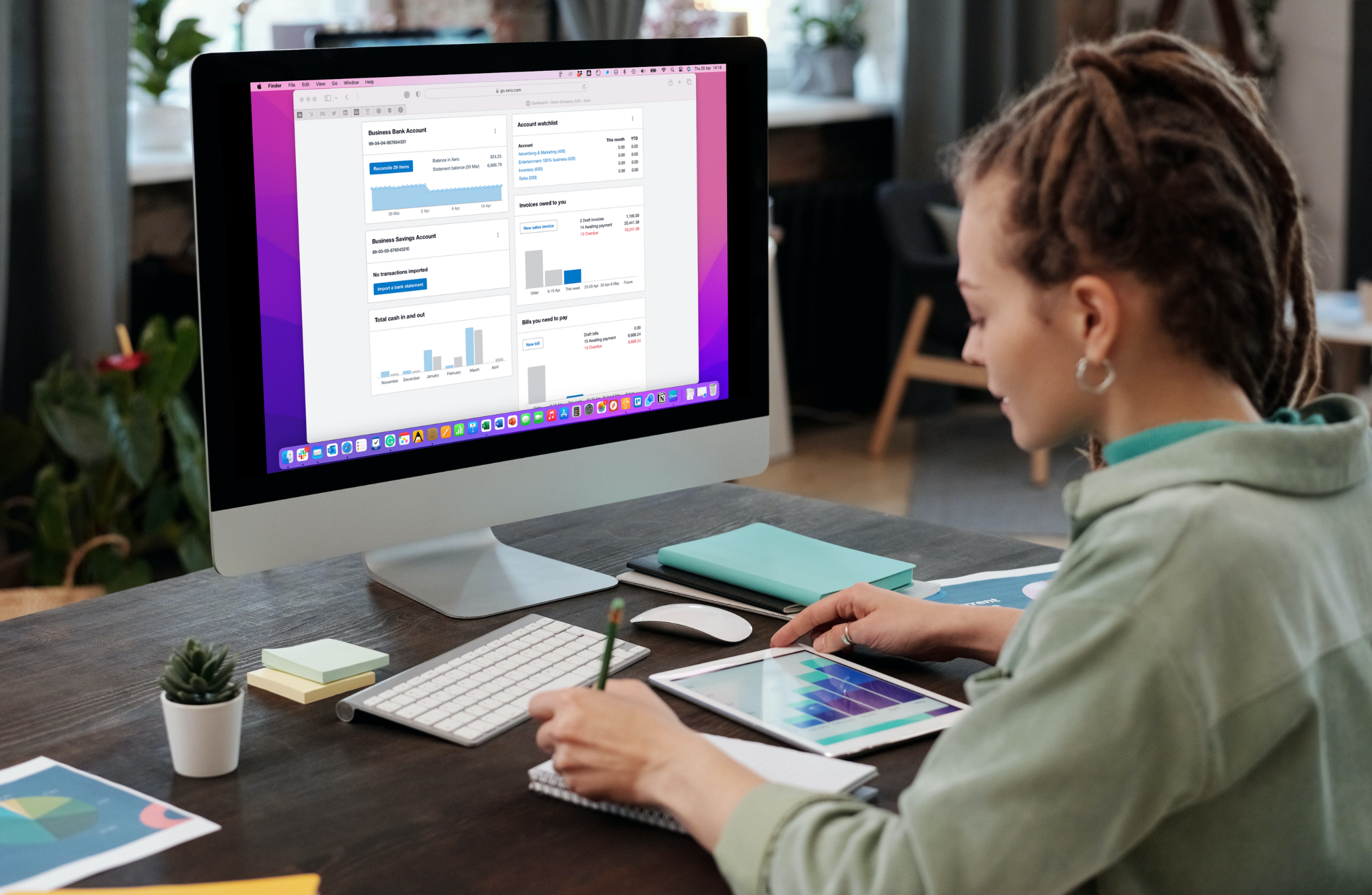

10 Xero Tips and Tricks - Our favourite Xero hacks

Are you trying to get the most out of Xero, the cloud accounting software? This post is just for you! We have gathered together our top 10 favourite Xero hacks and tips that are sure to make managing personal finances or a small business easier.

Spring Budget 2023 - What it means for SMEs

Chancellor Jeremy Hunt has unveiled the contents of his first budget in the House of Commons. During his speech, he announced incentives designed to help small businesses offset corporation tax rising to 25 per cent from next month.

Don’t ignore these 4 signs it’s time to hire a bookkeeper

As small business owners, we often start our ventures managing our books ourselves. However, as businesses grow and become more successful, so does the ever-growing list of things to-do.

Autumn Statement - What it means for SMEs

Chancellor Jeremy Hunt has unveiled the contents of his Autumn Statement in the House of Commons.

He has revealed tax rises and spending cuts worth billions of pounds and has frozen and reduced thresholds, meaning that many tax rises may not be immediately apparent.

5 Basics of Money Management your Bookkeeper Wants You to Know

Bookkeeping is something that can make many new small business owners feel anxious. However, you don’t need an accountancy degree to be able to manage your business finances.

Xero Education Month February 2022

Whether your business has been trading for a while, or just starting out, this is a chance to dive into a stack of free educational content from Xero's team of experts.